The landscape of social media and decentralised finance (DeFi) is experiencing a structural earthquake. In a coordinated move between technical decisions and regulatory needs, X (formerly Twitter) has officially updated its policies for developers, categorically banning any application that offers financial rewards to users in exchange for posts, replies or shares.

X's hard punch against InfoFi

Nikita Bier, a key figure on X's product team with a background in Meta, framed the decision as a necessary step to clean up the platform's so-called 'AI slop' - a flood of low-quality content generated by bots and algorithms to monetise engagement.

According to Bier, the model known as InfoFi (Information Finance), which aimed to financialise content distribution, has become the main cause of the spam that plagues the social network.

The impact was immediate: API access was revoked for all offending apps. In an almost defiant gesture, Bier offered X's help to assist affected developers in migrating to competing platforms such as Threads or Bluesky, signalling that for X, the 'pay-to-post' model no longer had a place.

We are revising our developer API policies:

- Nikita Bier (@nikitabier) January 15, 2026

We will no longer allow apps that reward users for posting on X (aka "infofi"). This has led to a tremendous amount of AI slop & reply spam on the platform.

We have revoked API access from these apps, so your X experience should...

What is breaking down in the InfoFi sector?

X's action strikes at the heart of the InfoFi infrastructure, which stood on three pillars: mindshare measurement systems, automated distribution mechanisms and token payment infrastructure. Without access to API data to verify user activity, the whole house of cards collapsed.

- Kaito: After discussions with X, it announced the closure of 'Yap', its flagship product that rewarded posts on crypto projects. Founder Yu Hu admitted that a 'totally permission-less' distribution system was no longer aligned with high quality brands.

- Cookie DAO: Terminated its 'Snaps' service to protect the integrity of its data layer.

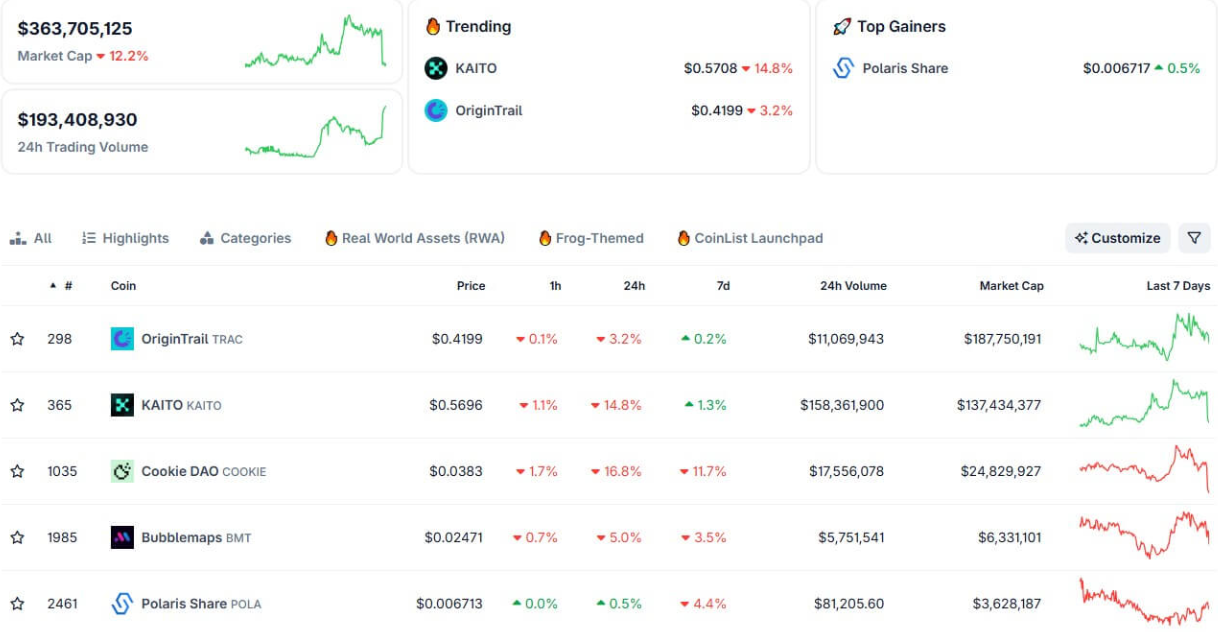

- Market Impact: According to CoinGecko's data, the InfoFi sector slumped 12% in just 24 hours, highlighting the systemic risk of building tokenized economies on top of centralised Web2 APIs.

Discord follows suit: from open squares to fortresses

As X shuts down APIs, the DeFi world is drastically downsizing its use of Discord. Once considered the beating heart of communities, Discord is now seen as a critical attack surface. The founder of DefiLlama, 0xngmi, was categorical: 'Discord makes it impossible to protect users from scammers'.

In DefiLlama, we are moving away from Discord and towards other channels, such as live support chat and email tickets. Discord makes it impossible to protect its users from scams: even if you ban the scammers instantly, they still contact users directly via DM to scam them," said the founder of DefiLlama on X.

at defillama we've also been moving away from discord into other channels like live support chat & email tickets

- 0xngmi is hiring (@0xngmi) January 14, 2026

discord makes it impossible to protect your users from getting scammed, even if you ban scammers instantly they still DM users directly to scam them https://t.co/ZLmw8yapFx

Leading projects such as Morpho and DefiLlama are turning their servers into 'read-only' mode, moving technical support to closed, traceable systems such as Intercom, email and live chat. The goal is to eliminate phishing via direct messages (DMs) and fraudulent impersonations of team members.

Three scenarios for the future of 2026

The consolidation of these defences suggests three possible regimes for the evolution of financial information:

- Curated Marketing: Curated marketing platforms will take over, replacing open rankings with programmes for verified creators and defined deliverables.

- Multi-Platform Distribution: "hedging" between different socials will become the standard to reduce the risk of dependence on a single API provider.

- InfoFi as Analytics Only: The industry may collapse into pure data analytics products, where sentiment measurement survives but the payout mechanics disappear or move entirely on-chain.

This transformation is not an isolated event, but the industry's response to brutal evidence: when spam and scams scale faster than defences, open communication channels cease to be a value-add and become an existential vulnerability.