What is Uphold?

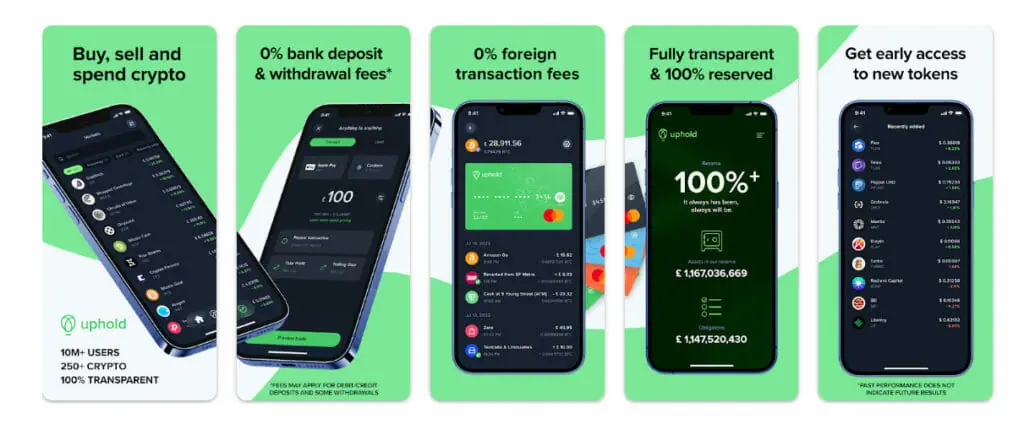

Uphold is a regulated crypto exchange and wallet custodial that provides financial services to its customers, such as trading and asset custody. The platform supports the transfer, conversion, holding and sale of various assets, including cryptocurrencies, precious metals and fiat currencies. Users can conduct all these transactions from a single account.

Founded in 2014, Uphold has positioned itself in the market as an intermediary between cryptocurrency-related services and traditional finance, offering simplified access to digital assets.

Uphold operates in multiple jurisdictions, including the United States (with the exception of New York State and the US Virgin Islands), the United Kingdom, France, the Philippines, and other countries in different regions. The integrated on-ramp and off-ramp fiat systems allow for smooth movement of assets between digital wallets and bank accounts.

How the Uphold Wallet Works

Custodial Model

Uphold is a custodial platform: it holds users' assets on their behalf. The security of funds is ensured through institutional-grade custodial solutions, without requiring users to directly manage private keys.

This model prioritises convenience and security over self-custody, with an emphasis on simplicity. The platform also employs data encryption mechanisms, two-factor authentication and proof of reserves to ensure transparency and protection for Uphold wallet users.

Assets Supported

Assets supported include USDC, DAI, major altcoins such as Solana (SOL), TRON, Avalanche (AVAX) and memecoins such as DOGE and SHIB. Fiat currencies include USD, EUR, GBP and other national currencies such as AUD or SEK. Uphold also supports precious metals such as silver, gold, platinum and palladium.

The platform allows direct exchange between different assets: for example, you can convert Tether (USDT) to gold or exchange silver for EUR or USD. The conversion takes place in a single step, with no intermediate transactions.

On-Ramp and Off-Ramp fiat

Uphold allows users to carry out on-ramp fiat transactions, i.e. the conversion of fiat currencies such as EUR or GBP into cryptocurrencies, and off-ramp transactions, which allow crypto assets to be converted into fiat currencies.

Uphold's on-ramp and off-ramp system complements traditional banking infrastructure, enabling bank transfers, withdrawals to linked accounts and purchases via debit and credit cards. Card availability depends on the region and local regulatory requirements.

Uphold vs. Other Crypto Exchanges

In comparison to other exchanges, Uphold differs in a few key features. The platform focuses on simple trading based on buy and sell functions, with no derivatives, margin trading or advanced order types. Unlike services that separate accounts by asset type, Uphold allows multiple assets to be managed within a single account.

In addition, Uphold uses a real-time reserve model, a feature generally absent from traditional crypto exchanges.

However, Uphold also has some limitations, such as the absence of advanced analysis tools or algorithmic trading. Professional platforms outperform Uphold in terms of technical depth and liquidity management. Furthermore, Uphold is less suitable for high-frequency trading.

Uphold vs Coinbase

Both Uphold and Coinbase are regulated platforms aimed at mainstream users. Coinbase offers more advanced trading tools and increased liquidity for active traders, while Uphold stands out for its broader multi-asset support, which also includes precious metals, and direct conversions between assets.

Uphold vs Binance

Binance offers extended trading functionality, lower spreads and high liquidity, but operates with more limited regulatory coverage in some regions. Uphold, on the other hand, relies on regulatory compliance, transparency and fiat integration, making it more attractive to regulation-conscious users.

Uphold vs Kraken

Kraken caters to experienced traders with advanced order routing and professional tools. Uphold's strength, on the other hand, is its accessibility and simplicity, making it a more suitable solution for beginners.

Costs, Spreads and Transparency Model

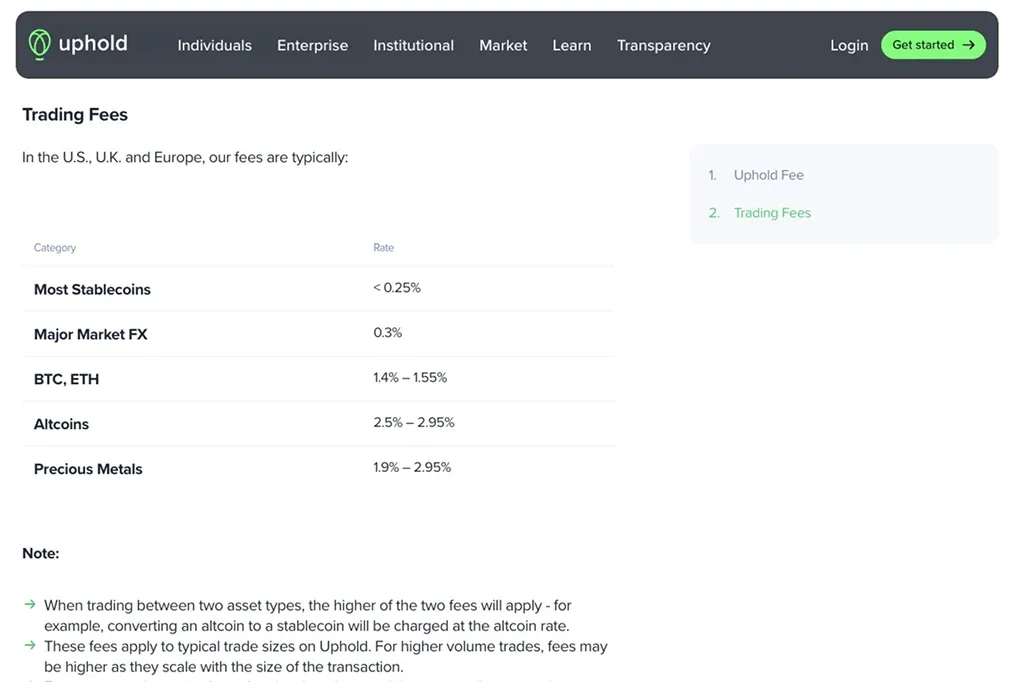

Uphold does not charge traditional trading fees. Instead, costs arise from spreads, the difference between the buying and selling price of an asset. When a user buys or sells an asset, part of this difference is retained as a commission.

There are no fixed commissions for trading. The value of spreads depends on the liquidity of the asset and market conditions. Network commissions apply to on-chain withdrawals. In general, spreads are lower for fiat-crypto pairs and higher for less liquid assets.

This model favours simplicity and clarity of costs, but may be less convenient for active traders who prefer smaller spreads and fixed fees. Uphold's transparency model aims to compensate for this by offering greater operational clarity, rather than competing solely on the lowest price.

Security, Compliance and Regulation

Security Measures

Uphold employs a secure infrastructure that includes SQL injection filters, email encryption, TLS protocol for the website and protection of private keys through advanced encryption methods. Restricted access controls reinforce the security of sensitive operations. The platform constantly updates software and security patches.

Because it is a custodial platform, Uphold takes responsibility for protecting users' funds, while also reducing the risk of human error such as the loss of private keys.

Compliance and Regulation

Uphold follows a compliance-first approach, applying KYC (Know Your Customer) procedures, anti-money laundering controls and complying with regional licences and regulatory registrations. This model allows the platform to operate under stable regulatory oversight.

Who is Uphold suitable for?

Uphold is particularly suitable for beginners looking for a platform with clear pricing and easy access to fiat currencies. It is also suitable for long-term investors who prefer to buy and hold assets rather than actively trade.

Other categories of users who may benefit from Uphold include those who use multiple assets and wish to diversify safely, and compliance-conscious users who favour regulation, transparency and institutional standards over decentralisation and anonymity.

Advantages and Limitations

Uphold's main strengths are its accessibility and regulatory compliance-oriented approach. The interface is intuitive and reduces the barrier of entry for new users, while allowing diversified assets to be managed from a single account.

The integration of on-ramp and off-ramp fiat facilitates the transfer of funds between traditional banking systems and digital assets. The focus on transparency, including the publication of reserves, contributes to user confidence. Moreover, Uphold's regulated model is particularly appreciated by those seeking legal clarity and institutional standards.

On the other hand, the custodial model does not allow access to private keys, a limitation for self-custody oriented users. The platform also offers limited advanced trading functionality, making it less suitable for professional traders. Lastly, the spread-based model can incur higher costs than specialised exchanges, especially for frequent or high-volume traders.

FAQ

Is Uphold safe and reliable?

Uphold employs institutional-grade security measures and operates within current regulations, making it safe for those who prefer custodial platforms.

Is Uphold a wallet or an exchange?

It is both. Uphold acts as a wallet for asset custody and an exchange for buying and selling, all in a single interface.

Does Uphold support fiat currencies?

Yes. Uphold supports 27 fiat currencies and allows the transfer of funds between bank accounts and digital assets.

Can I withdraw crypto from Uphold?

Yes, it is possible to withdraw supported cryptocurrencies to external wallets or accounts, subject to network fees and platform requirements.

Is Uphold suitable for advanced traders?

Uphold is primarily designed for simplicity and accessibility. Advanced traders may find it limited in terms of tools and functionality.