A vast network of cryptocurrency wallets linked to Russian state entities facilitated the movement of more than $8 billion in digital assets in a sophisticated operation aimed at circumventing Western sanctions.

This is according to a 26 September report by blockchain analytics firm Elliptic. The findings are based on a recent data leak that details how sanctioned Russian companies have relied on stablecoins - particularly Tether's USDT - to support cross-border trade and maintain active financial flows.

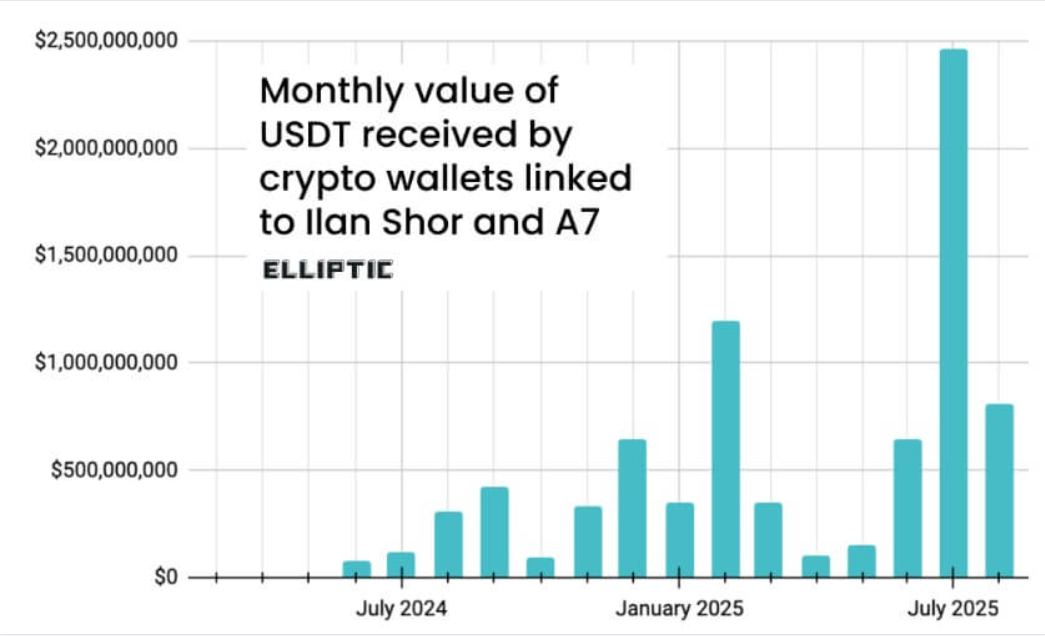

Elliptic traced many of these transactions to companies controlled by Ilan Shor, a sanctioned Moldovan fugitive and ally of Russian President Vladimir Putin.

Shor, who remains under US sanctions, allegedly used digital assets to maintain financial lifelines for Russian entities otherwise excluded from the global banking system.

In early September, Shor had personally reported to Putin during an online conference that his company, A7, had facilitated 7.5 trillion roubles($89 billion) in international payments over ten months, with more than half of that volume involving Asian partners.

Elliptic's data confirmed that A7-related wallets have received over $8 billion in stablecoin inflows over the past 18 months, corroborating the scale of the transactions.

The A7 Network and the Transition to the Stablecoin Anchored to the Ruble

A7 was founded in 2024 with the explicit aim of helping Russian companies circumvent sanctions and conduct cross-border settlements. The company is 49% owned by Promsvyazbank (PSB), a Russian state bank serving the defence sector.

Both PSB and A7 remain under US sanctions due to their close ties to the war economy. According to Elliptic, leaked internal messages revealed A7's initial heavy reliance on USDT for treasury operations and payments.

In one specific case, an A7 employee requested a transfer of $2 million USDT, exposing a wallet that had already processed some $677 million in trades.

However, Tether's ability to freeze sanctioned wallets became a vulnerability earlier this year when regulators shut down Garantex, a Russia-based exchange, and froze $26 million USDT.

As a result, Shor's network revamped its wallet infrastructure in August 2025. The company began promoting its own ruble-anchored stablecoin, A7A5, as a way around Tether's centralised controls.

Despite the strategic attempt, this effort has not yielded substantial progress. The A7A5 digital asset boasts an offering of only $496 million and has processed an estimated $68 billion in transactions, a figure that, while significant, highlights that the massive movement of funds has mainly been through pre-existing digital currencies.

The report underscores Russia's persistent challenge in sustaining global financial flows, forcing it to rapidly adapt its crypto strategies.