Continuous hours for a market that never sleeps.

The CME Group is considering the introduction of 24/7 continuous trading for certain derivative instruments related to cryptocurrencies. The initiative reflects an increasingly evident reality: digital assets operate without interruption, while the infrastructure of traditional markets remains anchored to limited hours.

The possible extension of hours would represent a significant change for one of the leading global players in derivatives markets, bringing regulated finance even closer to the 'always on' logic typical of the crypto world.

Because 24/7 is becoming inevitable

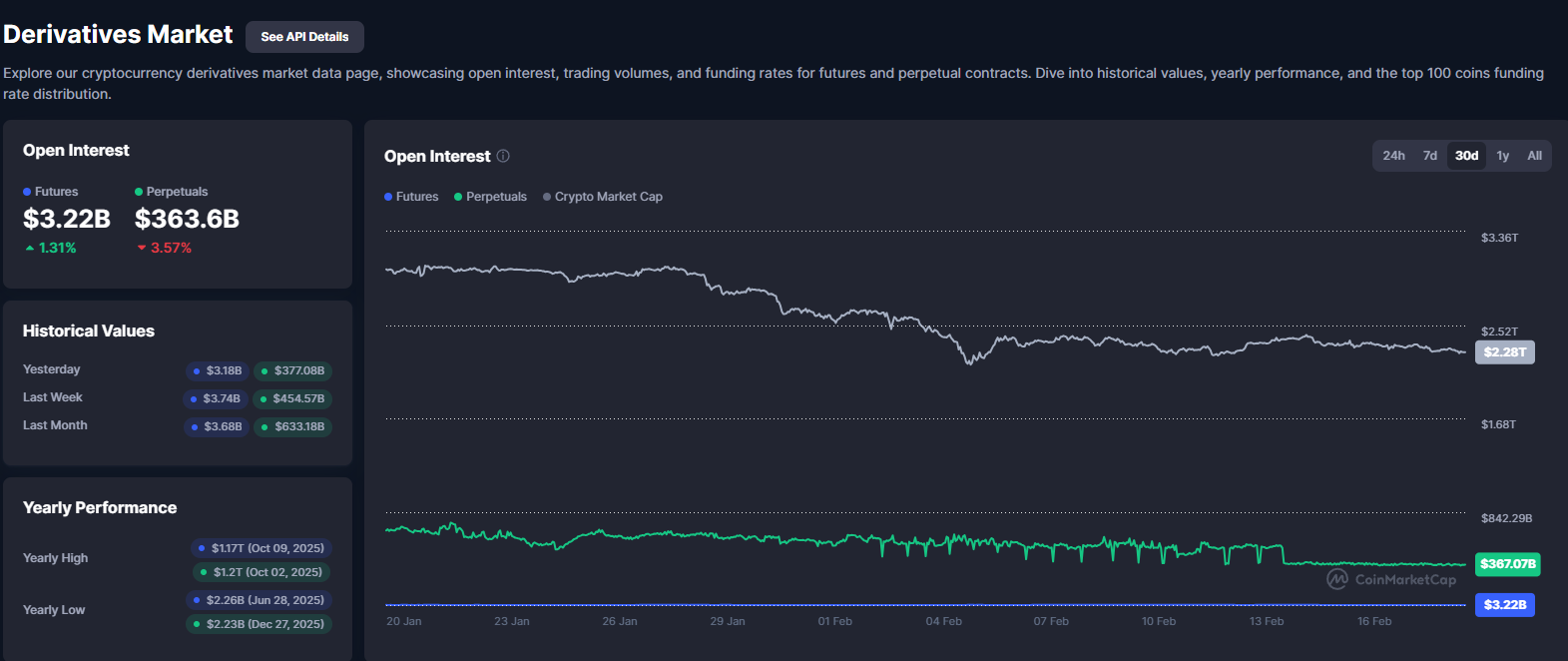

Cryptocurrencies are traded seamlessly on global platforms, making the gap with regulated markets that close during nights, weekends and holidays increasingly apparent. This time lag can generate price mismatches, difficulties in hedging risk and delays in position management. Allowing continuous trading on derivatives cryptos would allow traders to react in real time to market events, reducing the risk of sudden gaps when official sessions reopen.

An institutional demand signal

The CME's reflection comes at a time of growing institutional involvement in the crypto sector. Funds, professional trading desks and sophisticated investors are demanding instruments increasingly similar to those available on digital markets, but with guarantees of regulation and transparency.

The 24/7 trading of derivatives could improve the efficiency of markets by offering greater continuity in price formation and smoother management of liquidity.

Operational and technical implications

The introduction of continuous schedules is not without its complexities. Clearing, risk management and supervision systems have to be adapted to an environment where the market never stops. For an operator such as the CME, known for high standards of security and supervision, this implies significant investments in technology and processes.

However, the move towards always-on markets could become a competitive advantage, especially in a context where cryptocurrencies are pushing the entire financial sector to rethink its operating models.

A bridge between traditional finance and crypto

The eventual move to 24/7 crypto derivatives would represent a further step in the convergence of traditional finance and digital markets. Rather than forcing crypto assets to adapt to old patterns, it would be the regulated infrastructure that would move closer to their global and continuous nature.

This approach could make the CME's products more attractive to a new generation of traders, who are used to always-accessible markets and immediate reactions to news.

What to watch in the coming months

At the moment, the initiative is still under evaluation. Industry participants will be watching closely for any official announcements, pilot tests or consultations with market participants.

Key points to monitor include:

- which instruments would be included in the continuous trading

- the impact on liquidity and volatility

- the solutions adopted for clearing and risk management

- the response of institutional investors

Towards markets always more aligned to digital

If the CME were to proceed with 24/7 crypto trading, the signal would be clear: the line between traditional markets and digital assets is becoming increasingly blurred. This would not just be an extension of hours, but a structural adjustment to a financial world that now operates without breaks. In this scenario, continuous trading might not remain an exception for cryptocurrencies, but become a reference model for other financial instruments in the long run as well.