The New York Stock Exchange (NYSE) has officially announced the development of an advanced platform dedicated to on-chain trading and settlement of tokenized securities.

The project, led by parent company Intercontinental Exchange (ICE), aims to redefine the foundations of the global financial market by introducing a trading venue powered by a blockchain infrastructure for which the necessary regulatory permits will soon be sought.

A convergence between Pillar and Blockchain

The system is designed to overcome the time constraints of the traditional market, supporting 24/7 transactions. The new architecture combines the reliability of the NYSE's Pillar matching engine with blockchain-based post-trade systems.

This hybrid configuration will enable not only instantaneous settlement of transactions, but also the handling of fractional orders based on dollar amounts, supported by funding in stablecoin.

ICE specified that the platform will have the ability to interface with multiple blockchains for settlement and custody, although the specific networks that will be adopted have not yet been disclosed. The initial scope of operations will cover equities and ETFs listed in the US.

The tokenized shares will be fungible with traditionally issued securities or may be born directly as native digital assets, ensuring holders retain dividends and governance rights.

The Critical Node: Liquidity and Continuous Funding

The deeper implication of this announcement lies not so much in the technological 'wrapper' of the token, but in the decision to couple continuous trading with immediate settlement.

With the US markets transitioning to the T+1 cycle on 28 May 2024, the industry has already faced significant operational challenges. ICE's proposed model shifts the constraint from simple order matching to collateral mobility: to trade in an 'instant' regime, participants will need to pre-position liquidity, credit lines or on-chain assets at all times, even outside of traditional banking hours.

To solve this bottleneck, ICE is working with banking giants such as BNY and Citi to support tokenized deposits at their clearinghouses. The goal is to enable members to manage margins and funding obligations fluidly across different jurisdictions and time zones.

Towards a Digital Institutional Marketplace

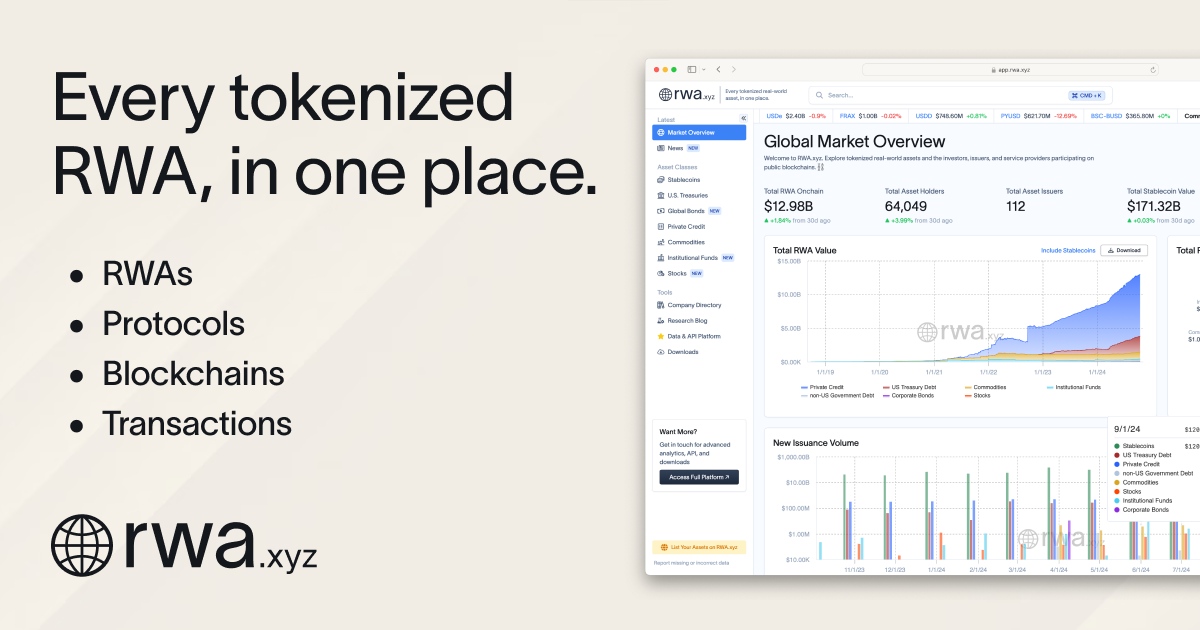

This strategy aligns with the DTCC's vision, which describes collateral mobility as the "killer app" for institutional use of the blockchain. A sign of the scalability of this trend comes from tokenized US Treasuries: according to data from RWA.xyz, the total value of these assets has reached USD 9.33 billion (as of 21 January 2026).

The convergence of traditional finance (TradFi) and digital infrastructure could also have direct repercussions on the cryptocurrency market. The integration of spot ETFs on Bitcoin has already created a solid bridge: Farside's data show impressive daily net inflows at the beginning of January 2026, with peaks of +$840.6 million on 14 January.

Macroeconomic Outlook

The success of this transformation will also depend on the macro environment. Projections by the OECD (OECD) indicate that the federal funds rate will remain stable through 2025, before falling towards 3.25-3.5% by the end of 2026. In a declining rate scenario, collateral efficiency becomes a priority for institutions seeking to optimise liquidity buffers.

Although ICE has not yet provided a definitive roadmap, the future of Wall Street seems mapped out: an ecosystem where the boundary between "market time" and "crypto time" is set to disappear, normalising the use of on-chain assets for institutional capital management.