Artificial intelligence-based crypto agents are experiencing a sharp decline, falling 13% in the past 24 hours, with market capitalisation reaching $6.42 billion. AI crypto tokens are also registering a decline, with FARTCOIN, AI16Z and VIRTUAL posting losses since last week.

Adoption of AI crypto agents has been slow, leading to a slump in engagement in the ecosystem of up to 60%. This highlights the decline in investor interest and market activity, unless a new technology fuels demand.

Crypto Agents are on a Downhill Road

AI-based crypto agents are taking a hit, with total market capitalisation falling to $6 billion. All of the top 10 crypto agents are reporting losses, with notable coins such as FARTCOIN (-61%), AI16Z (-59%) and VIRTUAL (-40%).

The main reason for the sector's difficulties is the exit of investors from their positions following the ongoing correction. This phenomenon started after the launch of DeepSeek AI.

VIRTUAL has been a key player in the crypto AI sector, surpassing major projects such as RENDER, FET and TAO, and reaching a market capitalisation of $4.6 billion on 1 January. However, it is now facing a steep decline, with its valuation dropping to just $811 million.

Currently, only 5 AI agents have managed to maintain their position on the list of capitalisations above $300 million. 15 projects have remained above the $100 million threshold, demonstrating the extent of the correction that is affecting the entire market.

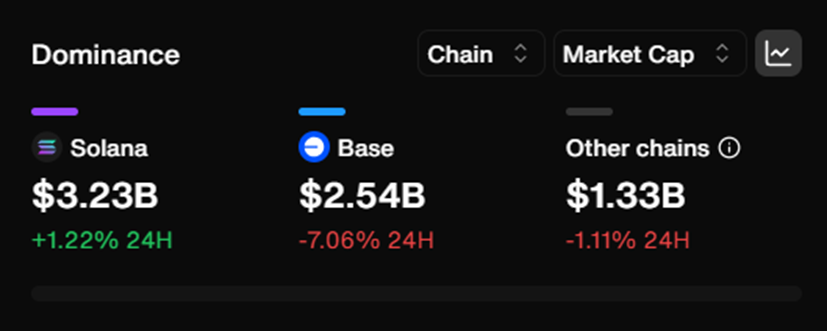

Despite the general chaos, Solana has managed to dominate the AI agent and AI coin market, maintaining a capitalisation of $3.2 billion. However, its ecosystem has also declined, with an 18.6 per cent loss in the last 24 hours.

Base Chain, the second largest player in the industry, is worth $2.5 billion. TOSHI, AIXBT, VIRTUAL, and FAI tokens are the main drivers of Base's growth.

Ethereum is absent from the list, while other blockchains have a combined capitalisation of only $1.33 billion.

As a whole, the growth of crypto AI agents has slowed after a surge in early January. Between 7 and 24 January, the number of crypto agents rose from 1,250 to 1,387, marking an 11% increase.

However, growth has stalled since then, with only 13 new agents introduced to the market. This highlights the gradual decline in interest in launching new AI agents, signalling a cooling-off phase in the sector.

In addition, engagement in the sector has dropped dramatically by 60%. Accounts that interacted with this marketplace dropped from 19,069 to just 7,541, indicating that fewer and fewer users are trading these agents.

With a decline in both user interaction and new project launches, recovery of the AI agent sector seems difficult unless a new catalyst emerges to revive interest.