Market capitalisation has mainly flowed into Ethereum over the past month. However, signs are emerging that indicate a possible reversal of inflows. Dogecoin (DOGE) appears to be one of the main altcoins poised to benefit from the next wave of capital.

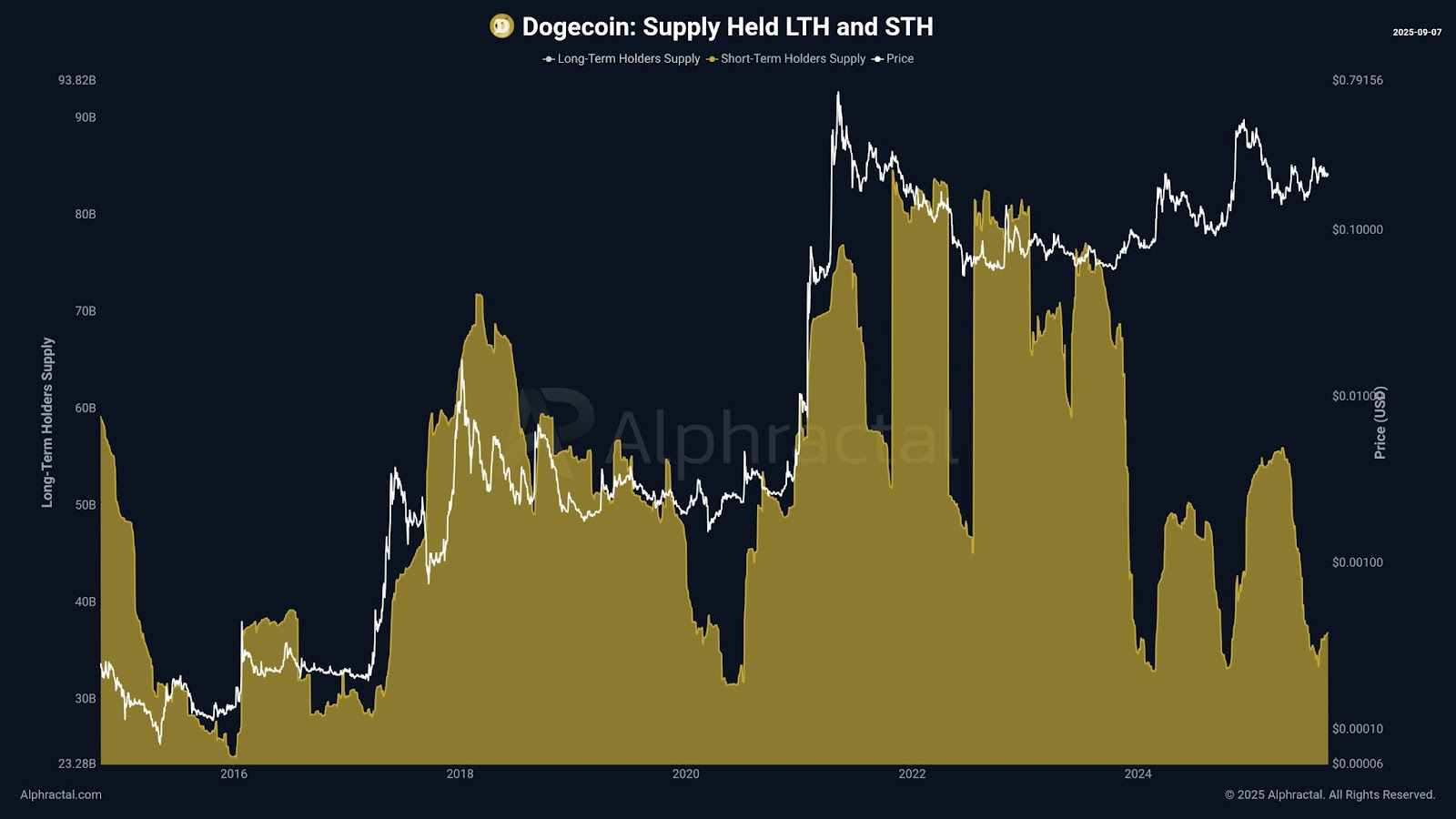

A key piece of evidence supporting this view is Dogecoin's Short-Term Holder Supply (STH Supply). Dogecoin's STH Supply - i.e. the total amount of DOGE held in wallets that have been active for less than 155 days - began to rise in early September 2025.

A rise in STH Supply is a classic market structure, usually accompanied by an influx of new capital from short-term investors and buyers.

"Dogecoin could see a rally if Short-Term Holder Supply continues to rise - and it appears that the accumulation has already begun. Historically, whenever STH Supply increased, it triggered a violent bull market for Doge. In recent weeks, this metric has risen and, if the trend continues, is very promising for memecoins. Remember: the market moves in waves, so volatility is normal. I emphasise this before someone says "but the market has gone down in the last few days." On-chain analysis is analytical interpretation, not guessing. If this metric continues to rise, it is indeed promising. So... are you accumulating Doge?" noted Alphractal.

Dogecoin could rally if Short-Term Holders' Supply continues to rise - and it looks like accumulation has already started.

- Joao Wedson (@joao_wedson) September 7, 2025

Historically, every time STH Supply increased, it triggered a violent Bull Market for Doge.

In recent weeks, this metric has been climbing, and if the... pic.twitter.com/jN3hg03k1G

Historical charts show the same dynamic during the bull markets of 2017 and 2021, when Dogecoin's STH Supply rose to triple digits before two of the most impressive rallies in DOGE's history.

Prediction market Polymarket data show that the probability of approval of an ETF on DOGE in September rose to 92%, the highest level of the year.

In the meantime, Rex Shares and Osprey Funds have announced the launch of an ETF called DOJE, which will track the performance of Dogecoin. This will be a 40-Act ETF, very similar to a spot ETF but with a typically faster approval process.

"The ETF (ticker: DOJE) is designed to offer investors a regulated and affordable exposure to the performance of Dogecoin. DOJE will be listed on the NYSE Arca. The ETF will be physically hedged and fully transparent. In other words, DOJE will directly hold Dogecoin (DOGE), with its fully-certified reserves updated daily on the website," the press release reads.

The SEC has yet to comment on requests from issuers such as Grayscale, Bitwise and 21Shares for a spot ETF on Dogecoin. The approval of an ETF on Dogecoin could act as a catalyst for the next DOGE rally, just as happened with Bitcoin (BTC) and Ethereum (ETH) earlier this year.

"$DOJE will be the first ETF to offer investors exposure to the performance of the iconic memecoin, Dogecoin $DOGE," REX Shares stated on X.

The REX-Osprey™ DOGE ETF, $DOJE, is coming soon! $DOJE will be the first ETF to deliver investors exposure to the performance of the iconic memecoin, Dogecoin $DOGE.

- REX Shares (@REXShares) September 3, 2025

From REX-Osprey™, the team behind $SSK, the first SOL + Staking ETF.@OspreyFunds

Investing involves risk.... pic.twitter.com/2eVv2hI7cf

Technically speaking, Dogecoin currently exhibits an expansive wedge shape on its chart. Wedge breakouts are typically bullish movements. This wedge is aiming for a target of $1.4 by the end of 2025.

Considering the return of short-term buyers to the market, growing optimism over the approval of an ETF on DOGE and positive technical patterns, Dogecoin has positioned itself as a potential beneficiary of the next round of capital inflows. Even with the risks involved, it is still worth paying attention to memecoin born as a joke.