Texas has taken the first formal step towards becoming the first US state to hold Bitcoin as a strategic reserve asset. On 25 November, Lee Bratcher, president of the Texas Blockchain Council, reported that the world's eighth-largest economy, valued at $2.7 trillion, purchased $5 million of the BlackRock, IBIT.

A Vanguard Financial Model

A second tranche of $5 million is already planned for the direct acquisition of Bitcoin, as soon as the state finalises the custody and liquidity framework required by a new reserve law. These two tranches create a bridge between the current institutional rails and a future in which governments not only purchase, but hold Bitcoin.

TEXAS BOUGHT THE DIP!

- Lee ₿ratcher (@lee_bratcher) November 25, 2025

Texas becomes the FIRST state to purchase Bitcoin with a $10M investment on Nov. 20th at an approximately $87k basis!

Congratulations to Comptroller @KHancock4TX and the dedicated investments team at Texas Treasury who have been watching this market... pic.twitter.com/wsMqI9HrPD

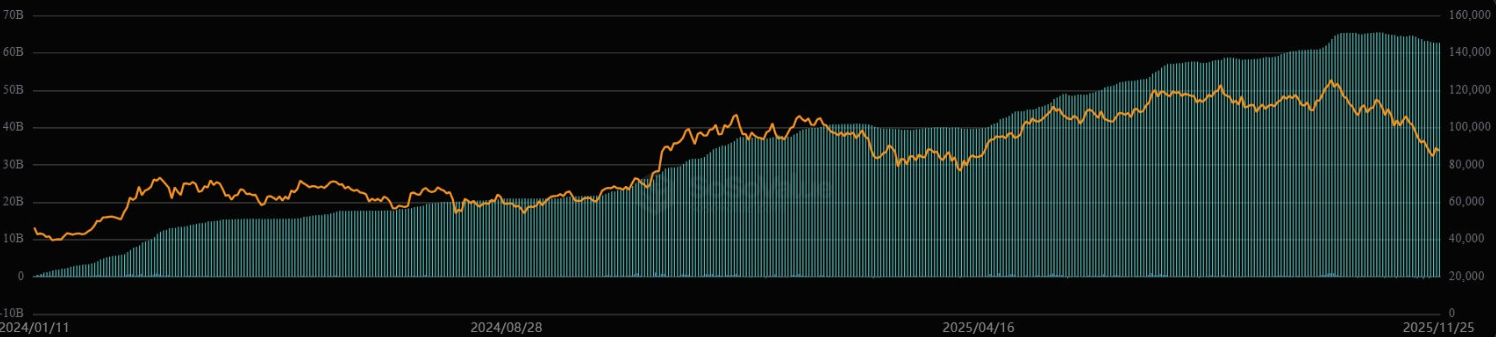

The initial purchase was made possible by Senate Bill 21, a law signed by Governor Greg Abbott in June that established the Texas Strategic Bitcoin Reserve. The framework allows the state comptroller to accumulate Bitcoin as long as the asset maintains a 24-month average market capitalisation of more than $500 billion. Bitcoin is the only cryptocurrency that meets this threshold.

The structure places the reserve outside the state treasury and introduces an advisory board to monitor risk and oversight. Although the first $5 million is a modest amount compared to the scale of state finances, the operational mechanisms are the most important thing. Texas is testing whether Bitcoin can be formalised as a public reserve instrument within a state financial system that manages hundreds of billions of dollars.

Custody and IBIT: The Texas Strategy

The initial exposure via IBIT is not a signal of preference for ETFs over native Bitcoin, but an operational solution. Creating a self-custody infrastructure for the public sector takes time and approvals, so BlackRock's ETF was used as a temporary placeholder.

The second tranche, on the other hand, will result in Bitcoin being self-custodied (self-custody), with significant implications for liquidity, transparency and audit practices. The state is designing procedures that resemble sovereign-level custody, with requirements for a qualified custodian, cold-storage capabilities, key management protocols and independent audit. These are the building blocks of a repeatable model that other states could adopt.

Avalanche Effect and Market Implications

The Texas model could trigger a domino effect. Analyst Shanaka Anslem Perera stated that: "The cascade is mathematical. Four to eight states are in position to follow within eighteen months, collectively managing more than $1.2 trillion in reserves'.

While purchases of ETF do not alter the circulating supply, self-custody removes coins from the float tradable, reducing the available supply. If other states adopted similar policies, Bitcoin's supply curve would become more inelastic, increasing price sensitivity and acting as a stabilising anchor against volatility. States like New Hampshire and Arizona already have Bitcoin reserve laws, viewing the main crypto as a strategic hedge against the global financial system.