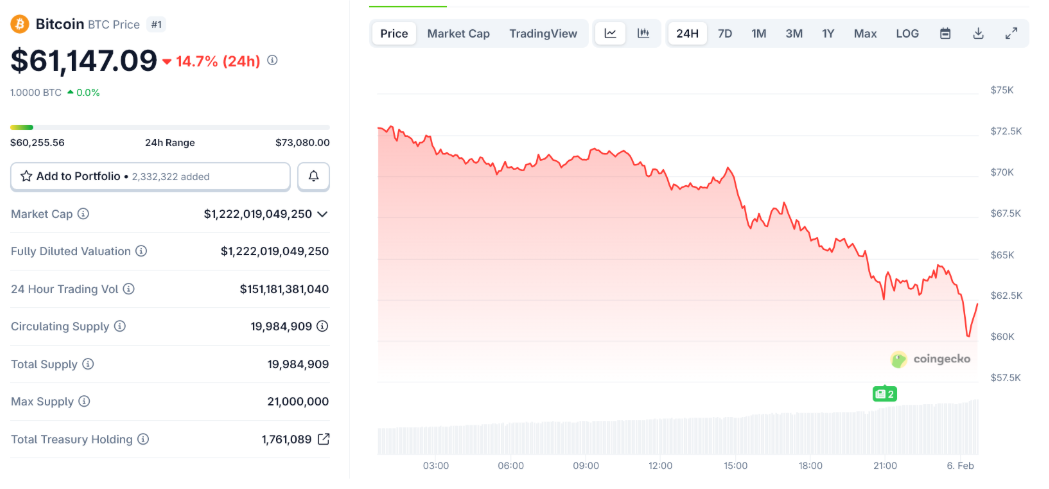

The aggressive accumulation strategy of Bitcoin pursued by MicroStrategy is facing one of the most critical market phases in recent years. With the major cryptocurrency's recent slide towards the psychological threshold of $60,000, the Michael Saylor-led company finds itself in a vulnerable position, with its vast digital treasure trove ending up well below the average acquisition cost.

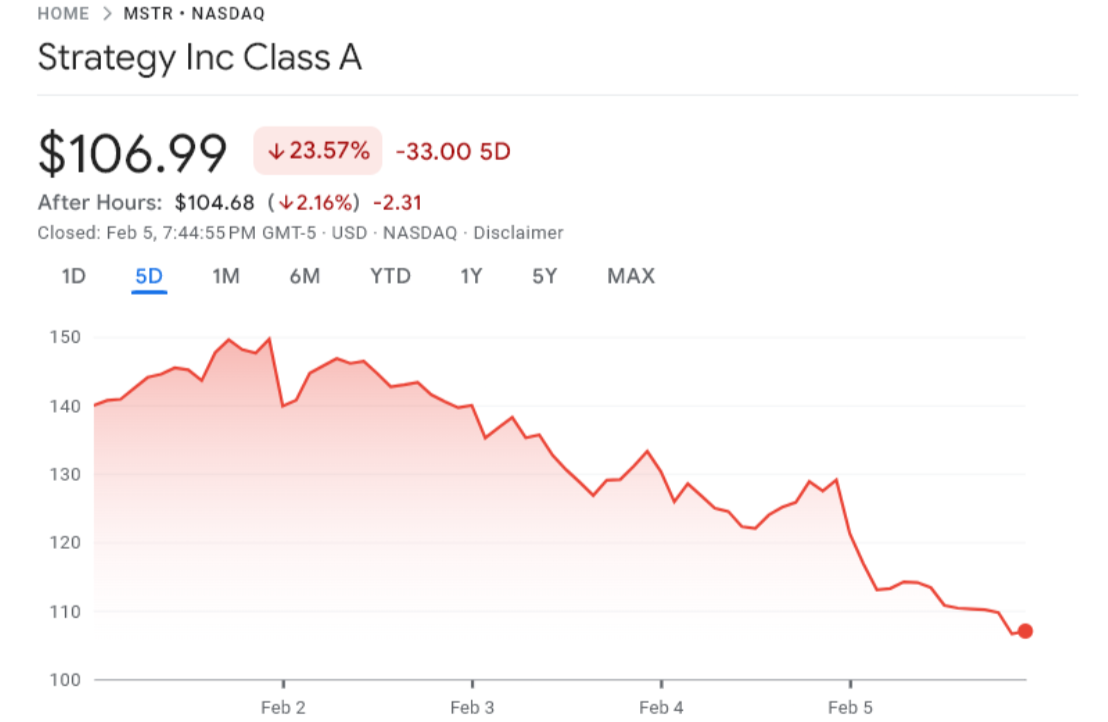

The company's stock has reacted with heavy declines, once again confirming its nature as a leveraged proxy for Bitcoin. However, the most alarming stress signal for analysts is not just the drop in the share price, but the fact that the company's market valuation has slipped below the value of the Bitcoins held on its balance sheet.

The collapse of the mNAV premium: an engine in trouble

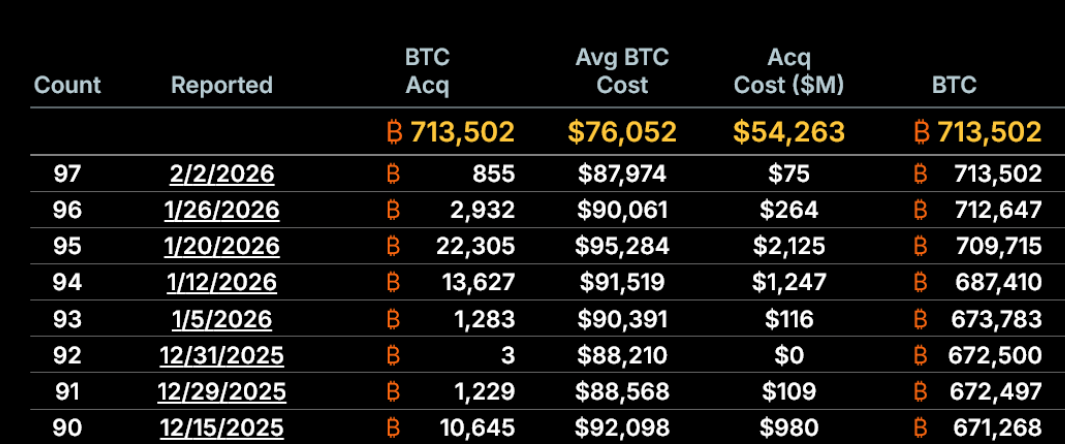

The numbers paint a picture of extreme financial strain. MicroStrategy currently holds around 713,500 Bitcoins, accumulated over time at an average carrying price of around $76,000 per coin. With Bitcoin trading near $60,000, the company's position is about 21% below its break-even, translating into billions of dollars in unrealised losses.

Although these are 'on paper' losses that do not force the company into immediate sales, the narrative impact is devastating. The investment thesis based on the perpetual growth of asset value has cracked, shifting investors' focus from long-term accumulation to short-term financial resilience.

The collapse of the mNAV premium: an engine in the doldrums

The most immediate problem for Michael Saylor concerns the so-called market Net Asset Value (mNAV). Recently, this indicator has fallen to around 0.87x, indicating that MicroStrategy's stock trades at a discount to the intrinsic value of the Bitcoins on its balance sheet.

Why is this data vital? The company's growth model is based on the ability to issue new shares at a premium to the value of the underlying asset to finance further Bitcoin purchases. If the premium disappears and becomes a discount, the issuance of new capital becomes dilutive to existing shareholders instead of being accretive. In simple terms, the company's main growth mechanism is currently frozen.

Defense and resilience: no solvency crisis yet

Despite the pressure, experts point out that MicroStrategy is not yet in a solvency crisis. Over the past two years, the company has raised about USD 18.6 billion through share issuance, taking advantage of favourable market moments when the stock was trading at a high premium.

These capital reserves allowed the company to build its current position without excessive forced dilution. Moreover, the company's debt structure works in its favour: maturities are long term and, at current price levels, there are no 'margin call' mechanisms directly linked to Bitcoin's spot price that could trigger forced liquidations.

Challenges on the horizon

However, the shift from expansive to defensive is evident. Catastrophic risk will remain high if Bitcoin were to stabilise below the average purchase cost for an extended period and if the capital market were to remain closed to new issuance.

In a stagnation scenario, debt refinancing would become significantly more costly, investor confidence could erode further and the risk of dilution would increase dramatically. For now, MicroStrategy remains afloat, but the margin for error has shrunk to a minimum, leaving the company's fate entirely in the hands of the next cryptocurrency market cycle.