The cryptocurrency landscape is undergoing a profound transformation. In recent days, investor interest has started to shift towards lower-capitalisation altcoins, signalling a rotation of capital away from the industry giants.

Many analysts believe that historical projects with billion-dollar valuations, such as Monero (XMR) and Dash (DASH), have now reached a saturation phase, prompting traders to look for opportunities with higher growth margins. Against this backdrop, Dusk (DUSK) emerged as one of the absolute stars of the month of January.

A performance bucking the trend

On 19 January, while the global market was showing signs of weakness with Bitcoin down almost 3% (slipping below the $93.000) and many altcoins losing between 5% and 10%, DUSK jumped 40%, hitting a high above $0.22. This is the highest level reached by the token since January 2025.

Since the beginning of the year, the value of DUSK has grown more than four times. According to data provided by Arkham, DUSK's trading volume on centralised exchanges (CEXs) surpassed $1.4 billion in the last week, marking the highest peak in the last year. At the time of writing this report, DUSK ranked in the Top 4 by 24-hour trading volume, preceded only by Zcash (ZEC), Monero (XMR) and Dash (DASH), confirming a massive influx of retail capital.

Attractiveness factors: Privacy and Compliance

What makes Dusk so attractive to investors compared to its competitors? The answer lies in its inherent value and technological approach. DUSK uses advanced cryptography based on Zero-Knowledge Proofs (ZK proofs) and zk-SNARKs. These technologies allow transaction details to be kept confidential, but with one key difference to Monero: they allow regulators access to the necessary data in case of audits.

While traditional privacy coins face increasing legal challenges and delisting due to their total anonymity, Dusk proposes a 'middle ground'. As explained by investor Paxton, companies need privacy to protect their operations, while authorities require transparency for regulatory compliance. Dusk sits squarely in this balance, making it attractive for institutional adoption.

In addition, the speculative factor plays a key role. With a market capitalisation of just over USD 100 million, DUSK is seen as a project with far greater upside potential than large-cap projects that have already experienced their major rallies.

Warning signs from on-chain data

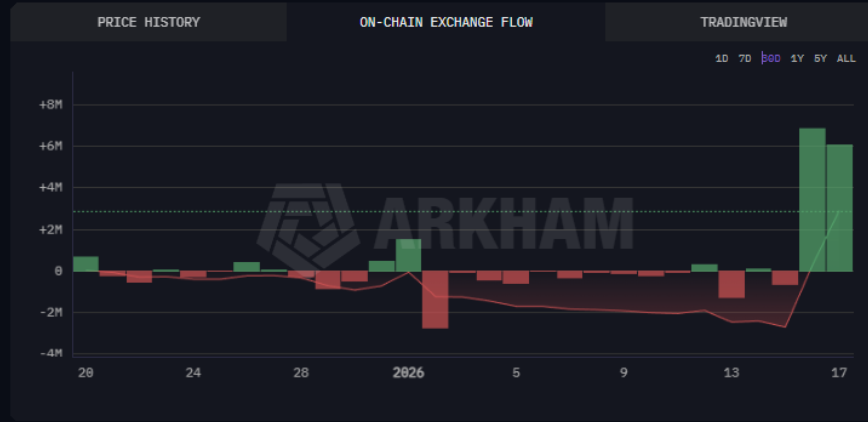

Despite the enthusiasm, there is no shortage of warning signs. A fourfold increase in price in less than a month exposes the asset to strong corrections. Arkham's data on exchange flows provides a clear warning: between 16 and 17 January, DUSK inflows to exchanges exceeded 6 million tokens per day.

Private by default, responsible when required. Shielded transfers of $DUSK hide sender and amount from the public, while the recipient can still verify (and cryptographically prove!) who paid it. This missing piece makes privacy on Dusk much more compliant and suitable for the 'travel rule', said said Hein Dauven, CTO of Dusk, on X.

Private by default, accountable when required. $DUSK shielded transfers hide sender/amount from the public, while the receiver can still verify (and cryptographically prove!) who paid them.

- Hein Dauven (@HeinDauven) January 17, 2026

This missing piece makes privacy on Dusk much more travel-rule-friendly and compliant. https://t.co/yjBdsnS16U

This spike in deposits, the highest in 30 days, suggests that early investors are beginning to liquidate their positions to monetise profits. Historically, when capital aggressively rotates towards "small-caps" within a specific narrative, it could indicate that that sector's growth cycle is nearing an end.

Conclusions and outlook

The DUSK rally represents an interesting case study of capital dynamics in 2026. While technological innovation and regulatory compliance provide solid foundations for the future, the speed of the climb and the return of 'fear' sentiment in the global market suggest caution. For those who decide to enter at these levels, the risk of a retracement due to profit-taking is real, especially considering the record volumes entering the exchanges.