Christmas Day sent an unmistakable signal to global financial markets. While Bitcoin traded sluggishly amid low holiday liquidity, silver prices in China jumped to record levels, driven by a combination of extremely tight physical supply and insatiable industrial demand.

This divergence underscores an increasingly evident macroeconomic theme: in times of scarcity and geopolitical tensions, capital favours physical assets over digital alternatives.

The Rally-Driver: The Supply Crisis in China

The recent bullish breakout originated in the Chinese market itself, where on 25 December local prices reached unprecedented heights. China is facing a structural shortage of physical silver, a situation that has worldwide repercussions.

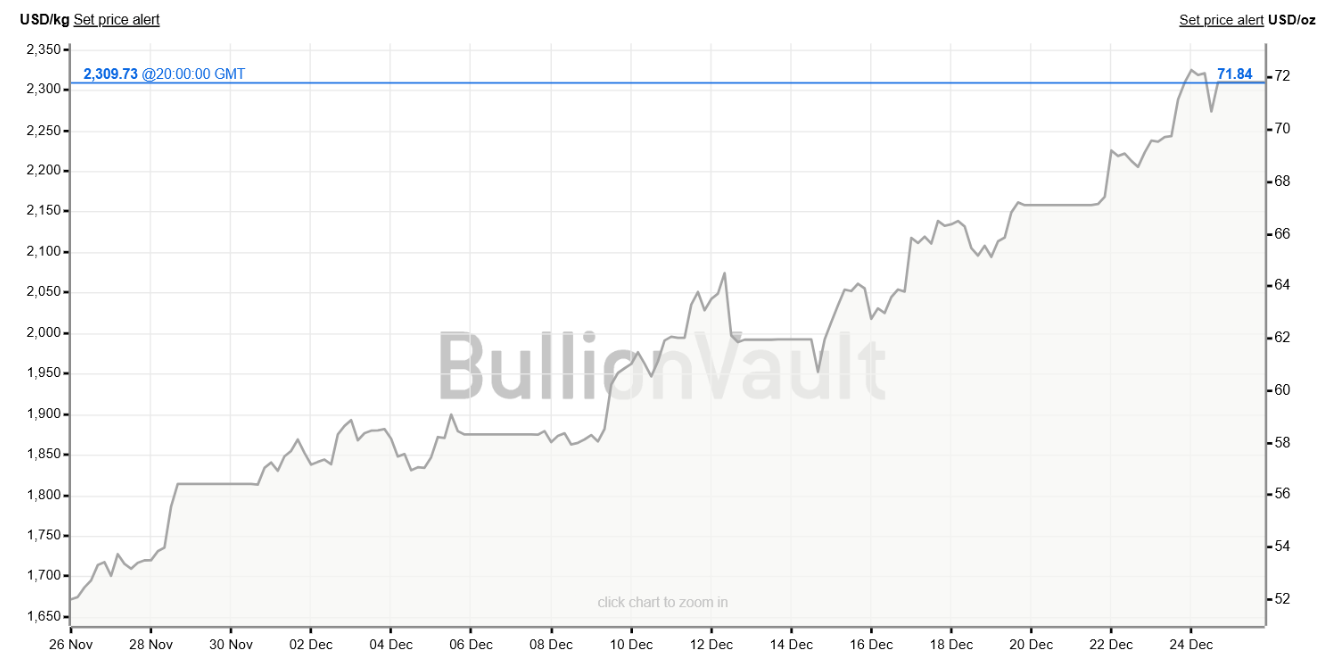

Globally, the spot price of silver has settled near all-time highs of around $72 an ounce, capping an extraordinary rally that has seen prices rise by more than 120% over the course of 2025.

ULTIMATE TIME: Silver prices in Shanghai have soared to a record $80 an ounce, officially marking a rise of more than +150% since the beginning of the year. China is facing a real shortage of physical silver, stated The Kobeissi Letter on X.

BREAKING: Shanghai silver prices soar to a record $80/oz, now officially up over +150% YTD.

- The Kobeissi Letter (@KobeissiLetter) December 25, 2025

China is facing a literal shortage of physical silver. pic.twitter.com/p41GOnZ47X

For comparison, gold also posted solid gains with a 60 per cent rise, while the closed the month of December down after peaking above $120,000 in October.

Chinese spot and futures markets showed persistent premiums against London and COMEX benchmarks. In some cases, contracts briefly entered 'backwardation', a technical indicator signalling immediate stress in supply.

Since China accounts for more than half of global industrial demand for silver, a domestic shortage quickly becomes a global systemic problem.

Photovoltaics and EVs: The Pillars of Industrial Demand

Pricing pressure stems from several key sectors of the energy transition. Solar manufacturing remains the main driver of demand, but electric vehicle (EV) production continues to exert significant pressure. Each EV uses significantly more silver than a conventional car, especially in power electronics and charging infrastructure.

In addition to sustainable mobility, the expansion of power grids and the production of advanced electronic components have kept demand at unprecedented levels. Unlike silver for investment (bullion or coins), much of this metal used in industry is permanently consumed, making recycling complex and market availability increasingly scarce.

Bitcoin and the paradox of risk protection

In contrast, the Bitcoin showed no significant reaction during the holiday season. Prices moved sideways amid low volumes, reflecting reduced institutional participation rather than a change in fundamentals. However, what is striking to analysts is the absence of defensive flows to the main cryptocurrency.

In this late 2025, Bitcoin has been trading more as a high beta asset tied to liquidity than as a crisis shelter asset. When the dominant narrative becomes physical scarcity and supply chain stress, investors seem to prefer metals.

Geopolitical risks only reinforce this trend: increased defence spending, linked to conflicts in Ukraine and the Middle East, has increased the use of silver in military electronics and ammunition.

Physical Scarcity vs Digital Scarcity: Towards 2026

The divergence between silver and Bitcoin reflects a key macroeconomic point: digital scarcity alone has not been sufficient to attract capital during physical supply-side shocks. The concreteness of an asset linked to energy, defence and industrial policy continues to make a difference in investors' portfolios.

As markets prepare to enter 2026, this distinction between 'real scarcity' and 'algorithmic scarcity' could shape asset performance far more than just risk appetite sentiment. Silver, with its dual nature as a precious metal and an indispensable industrial raw material, is a candidate to be the absolute protagonist of the next economic scenario.