Predictive betting and stablecoins: a combination that accelerates on-chain finance

The world of predictive markets is entering a new phase of maturity. Platforms that allow users to bet on the outcome of political, economic and social events are evolving rapidly, and one of the main levers of this transformation is the direct integration of regulated stablecoins as a settlement tool.

The strategic agreement between a large prediction market platform like Polymarket and a stablecoin issuer like Circle, with the use of USDC for settlement, represents more than just a technical upgrade. It is a step that strengthens the credibility of the entire industry and brings it closer to the standards of regulated digital finance.

The goal is clear: to make predictive markets more transparent, faster in settlement and more reliable for a global audience.

Faster settlement and reduced risk

In the prediction markets, the settlement phase - i.e. the moment when bets are settled - is crucial. Delays, uncertainties or unstable payment instruments can undermine user confidence. The use of a widely adopted, dollar-anchored stablecoin such as USDC aims to solve precisely this problem.

Stablecoin settlement enables near-instantaneous and verifiable on-chain transactions, with a higher level of transparency than traditional closed systems. In addition, the use of a stable digital asset reduces exposure to volatility typical of unanchored cryptocurrencies.

For platforms, this means improved user experience and reduced operational friction.

Standardization of financial flows

The adoption of USDC also introduces a standardisation advantage. Using a stablecoin widely integrated into the crypto ecosystem allows for easier connections with wallets, exchanges and DeFi services. In practice, users can move funds between different environments without complex conversions, with obvious efficiency benefits. Among the most immediate effects of the integration of a regulated stablecoin are:

- better speed in payments and redemptions;

- less uncertainty about the value of winnings;

- greater compatibility with existing crypto tools and infrastructures;

- complete traceability of transactions.

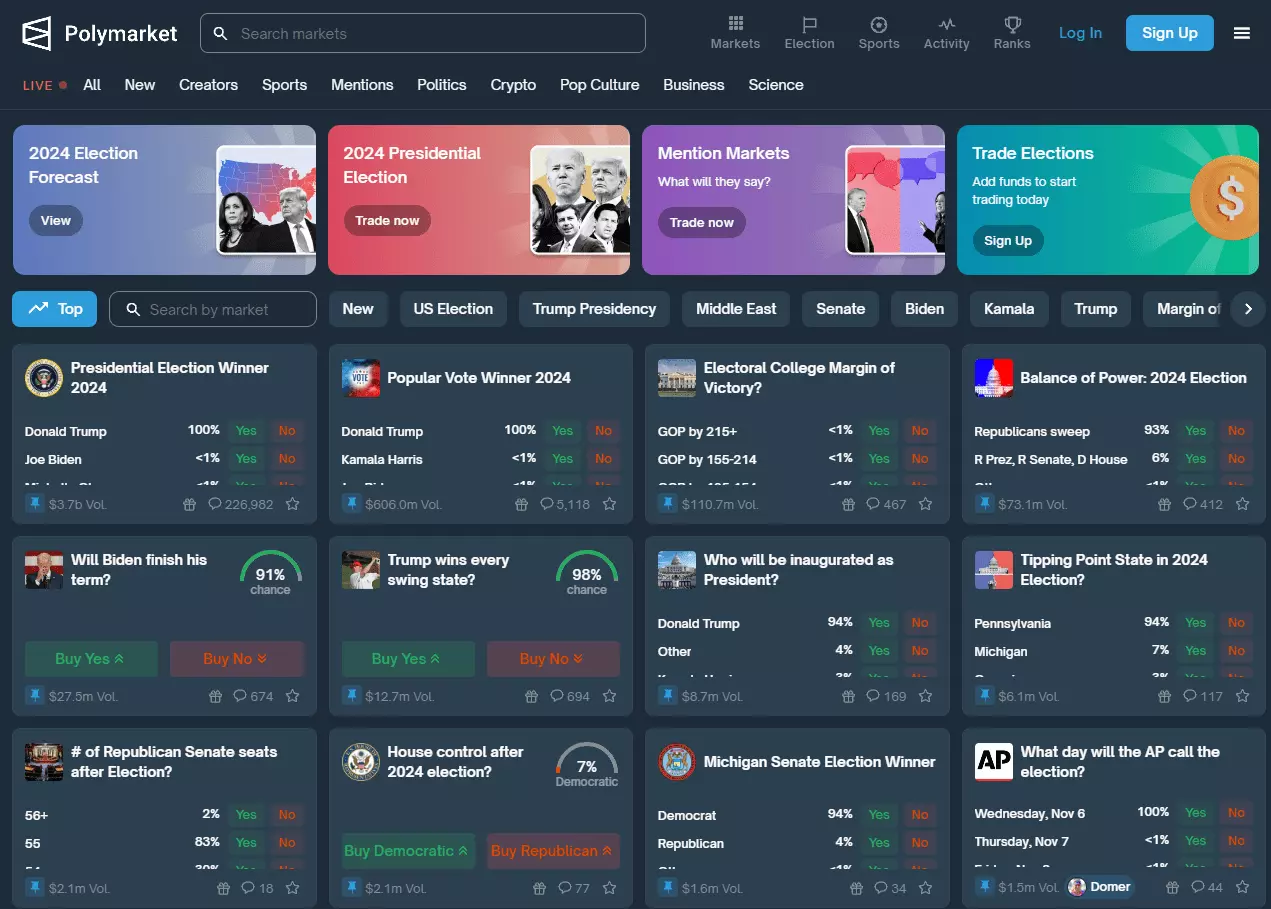

Polymarket and the evolution of prediction markets

From experimental niche to informative tool

Prediction markets have, in just a few years, gone from being niche experiments to tools observed with interest even by analysts and the media. In many cases, the probabilities expressed by the market have proven to be more dynamic and responsive than traditional polls.

Platforms such as Polymarket have contributed to this growth by offering markets on:

- elections and political scenarios;

- central bank decisions;

- regulatory approvals;

- macroeconomic and technological events.

The integration of a more robust payment system is a further step towards the professionalisation of the industry.

Liquidity and trust as key factors

Two elements determine the success of a predictive market: liquidity and trust. Without sufficient capital at stake, prices do not correctly reflect probabilities. Without confidence in the settlement, users hesitate to participate.

The use of a recognised and widely verified stablecoin aims to reinforce both aspects, creating a more attractive environment for even semi-professional traders.

The adoption of USDC will ensure a uniform settlement standard anchored to the dollar, reinforcing market integrity and platform reliability as the number of participants grows.

Towards more integrated predictive markets in digital finance

The collaboration between prediction market platforms and large stablecoin issuers signals a clear trend: predictive markets are seeking legitimacy and infrastructural stability. No longer just decentralised experiments, but components of a broader digital financial ecosystem. If this model consolidates, we could see the emergence of prediction markets that are increasingly liquid, transparent and integrated with global digital payment systems. At that time, collective forecasting will not just be a speculative game, but a financial instrument in its own right.