In the world of cryptocurrencies, access to digital assets almost always passes through two key tools: on-ramp and off-ramp.

These services are the direct link between the traditional financial system and the blockchain ecosystem, allowing users to enter and exit the crypto world in an easy and regulated way.

Understanding what they are, how they work and how they differ is crucial for anyone who wants to use cryptocurrencies in an informed, safe and practical way.

What Are On-Ramps and Off-Ramps in Crypto

In the cryptocurrency industry, the concepts of on-ramps and off-ramps represent the fundamental link between the traditional financial system and the blockchain ecosystem. Without these tools, access to digital assets would be limited exclusively to users already on-chain, drastically reducing the overall adoption of cryptocurrencies.

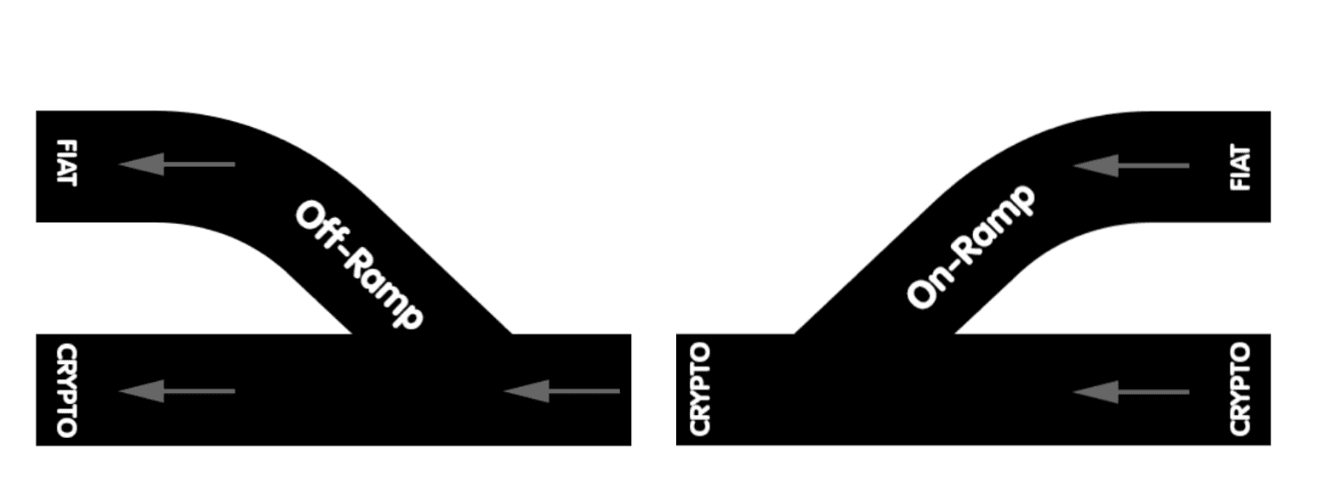

On-ramps allow for the conversion of fiat currencies into cryptocurrencies, while off-ramps allow for the reverse process, i.e. the conversion of digital assets into traditional currencies. Both play a crucial role in making cryptos a usable system in real life.

What is a Crypto On-Ramp

A crypto on-ramp is a service that allows users to buy cryptocurrencies using fiat currencies such as euros, dollars or sterling. These tools are the main entry point for new users approaching the world of cryptocurrencies.

On-ramps can be integrated directly into centralised exchanges, custodial or non-custodial wallets and even into Web3 applications. Their main objective is to simplify access to cryptos, reducing technical complexity and offering familiar payment methods.

How an On-Ramp Works

The operation of an on-ramp generally involves verifying the user's identity through KYC procedures, connecting a traditional payment method and converting the fiat currency into cryptocurrency. Once the transaction is complete, the digital assets are credited to the user's wallet or account.

This process often takes place in real time or near real time, making the experience similar to that of a traditional online purchase.

Supported Payment Methods

On-ramp cryptos support a variety of payment methods, including bank transfers, credit and debit cards, electronic payment systems and, in some cases, region-specific local solutions. The availability of methods varies by provider and jurisdiction.

What is a Crypto Off-Ramp

A crypto off-ramp is a service that allows users to convert cryptocurrencies into fiat currency and transfer the funds to a bank account or other traditional financial instrument. Off-ramps represent the exit point from the crypto ecosystem into the real world.

These tools are essential for monetising earnings, covering day-to-day expenses or simply reducing exposure to digital assets.

How an Off-Ramp Works

The off-ramp process involves selling cryptocurrencies at a certain exchange rate, followed by transferring the resulting fiat currency to the user's selected payment method. Again, regulatory compliance checks are often required.

Crediting times can vary from a few minutes to several working days, depending on the banking infrastructure used.

Off-Ramp Types

Off-ramps can be integrated into centralised exchanges, custodial wallets or offered through third-party services. Some solutions also allow for the direct use of cryptocurrencies via linked cards, eliminating the need for immediate conversion.

On-Ramp vs Off-Ramp: Principal Differences

The fundamental difference between on-ramp and off-ramp lies in the direction of value flow between the traditional financial system and the cryptocurrency ecosystem. On-ramps represent the entry point, allowing the conversion of fiat currency into digital assets, while off-ramps perform the opposite function, allowing users to convert cryptocurrencies back into traditional currency.

Operationally, on-ramps are designed to facilitate user onboarding by reducing technical and cognitive barriers for those new to crypto.

They are therefore strongly oriented towards user experience, ease of use and integration with familiar payment methods such as cards and bank transfers. Off-ramps, on the other hand, are more focused on cash management and the real expendability of digital assets. They enable users to transform accumulated on-chain value into usable resources in everyday life, such as payments, savings or traditional investments. This makes them essential tools for the maturity and sustainability of the crypto ecosystem.

Although both are subject to similar regulatory frameworks, on-ramp and off-ramp can differ significantly in terms of cost structures, processing times, geographic boundaries and compliance requirements. Understanding these differences is key to choosing the solution that best suits your operational and financial needs.

Use Cases of On-Ramp and Off-Ramp

On-ramps are mainly used by new users who wish to purchase cryptocurrencies for investment purposes, experimentation or participation in Web3 projects. They represent the first point of contact with the blockchain and play a key role in educating and retaining users. In addition to individuals, companies, start-ups and institutions are also using on-ramps to convert traditional capital into digital assets.

This is particularly relevant for companies operating in Web3, DeFi or the NFT, where direct access to cryptocurrencies is essential to operate.

Off-ramps, on the other hand, are indispensable for traders and investors who wish to monetise their earnings or reduce their exposure to volatility risk. They allow value to be carried over from the crypto world to the fiat world in a way that complies with current tax and financial regulations.

In the commercial arena, off-ramps allow merchants to accept cryptocurrency payments and automatically receive fiat currency, eliminating the risk associated with price fluctuations. This model encourages the adoption of cryptocurrencies as a means of payment without requiring advanced technical skills from merchants.

Role of On-Ramp and Off-Ramp in Crypto Adoption

On-ramp and off-ramp play a central role in the mass adoption of cryptocurrencies, acting as a bridge between two profoundly different economic systems. Without these tools, the blockchain ecosystem would remain isolated, accessible only to technically savvy users or those already established in the industry.

The presence of efficient on-ramps drastically lowers the barriers to entry, making cryptocurrencies accessible to a wider audience. At the same time, off-ramps ensure that the value generated on-chain can be concretely utilised in the real world, increasing user trust and perceived usefulness of blockchain technologies.

The integration of on-ramps and off-ramps within wallets, exchanges and Web3 applications helps to create a seamless, fluid experience where the user can move freely between fiat and crypto. This continuity is essential for transforming cryptocurrencies from a speculative tool to a global financial infrastructure.

Advantages and Limitations

The main advantages of on-ramps include ease of use, accessibility and speed of conversion. They allow even users without advanced technical knowledge to access the crypto world in just a few steps, fostering financial inclusion and the spread of decentralised technologies. However, on-ramps also have some limitations. Transaction costs can be higher than for purely on-chain solutions, and identity verification requirements can be invasive for privacy-conscious users.

Security and Compliance Considerations

On-ramp and off-ramps operate in an increasingly complex and regulated environment. KYC and AML procedures are implemented to prevent fraud, money laundering and other illicit activities, ensuring compliance with international laws.

These requirements, although necessary, introduce trade-offs in terms of privacy and decentralisation, two fundamental tenets of the crypto ecosystem. Users must therefore balance the need for security with the desire for autonomy and control over their data. The security of transactions largely depends on the robustness of the provider's technical infrastructure, the custody practices adopted and operational transparency. Choosing reliable and regulated providers is a crucial step in reducing risk and ensuring secure on-ramp and off-ramp usage.

FAQ

What is the difference between on-ramp and off-ramp?

On-ramps allow the conversion of fiat currencies into cryptocurrencies, while off-ramps allow the reverse conversion from crypto to fiat.

Do on-ramps require KYC?

In most cases yes, especially when they involve traditional banking systems.

Can cryptos be used without off-ramps?

Yes, but off-ramps are required to convert digital assets into fiat currency.

Are on-ramps and off-ramps decentralised?

Generally no, as they require integration with traditional financial infrastructures.

Which is more important, on-ramp or off-ramp?

Both are essential to ensure accessibility, liquidity and usability of the crypto ecosystem.