GoTyme Bank, one of the fastest growing digital banks in the Philippines, has launched crypto services through a new integration with US fintech company Alpaca. The innovation allows users to purchase and store 11 digital assets directly in GoTyme's banking app, including Bitcoin (BTC), Ethereum (ETH), Solana (SOL) and Polkadot (DOT).

The feature automatically converts Philippine pesos to US dollars before purchase, eliminating the need for external exchanges or complex financing processes.

Easy crypto buying within a banking app

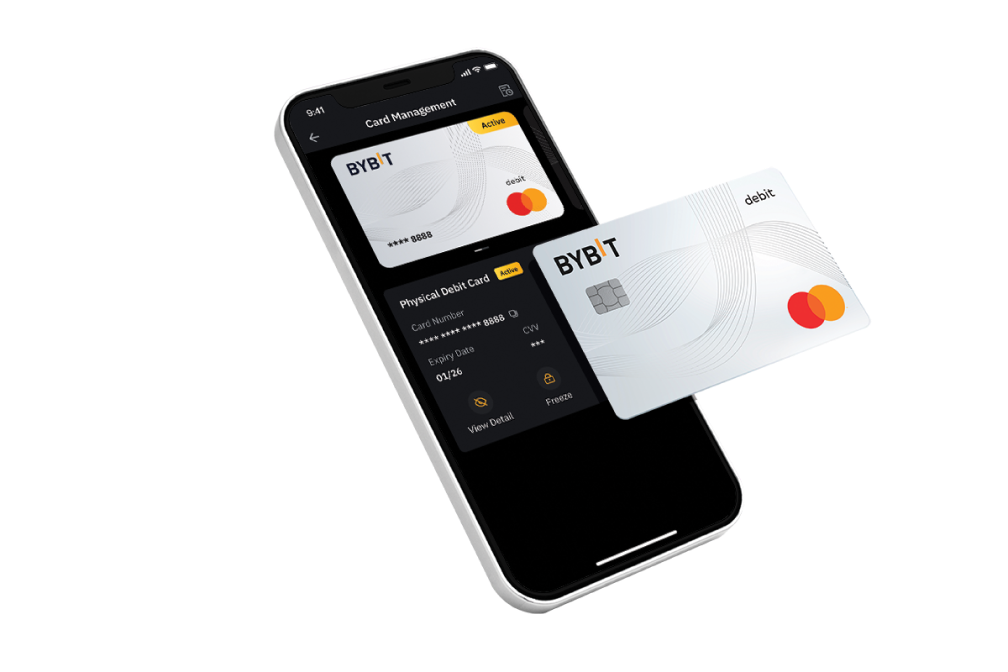

The new product focuses on ease of use rather than advanced trading tools. Customers can open a bank account and obtain a debit card via the app in less than five minutes, after which they can access cryptocurrencies.

"Our product focuses on simplicity and reliability, designed for people who want to buy crypto with confidence without complicated technical analysis or managing multiple apps," said GoTyme CEO Nate Clarke.

The crypto service is built on Alpaca's infrastructure, offering customers real-time pricing and secure custody.

Rapid growth and expansion plans

GoTyme was launched in October 2022 and has already built a customer base of more than 6.5 million. The digital bank is backed by Singapore-based Tyme Group and the Philippines-based Gokongwei Group.

In addition to cryptos, the bank is targeting regional expansion and market share gains in digital finance. Clarke recently said that GoTyme is prioritising growth over profits and does not plan to optimise for profitability until 2027.

"We are still in a growth phase. We are not optimising for profitability right now. What's important for us is to build a growing and engaged customer base," he said.

The company has signalled potential expansion into Vietnam and Indonesia to take advantage of the fast-growing digital banking sector in Southeast Asia.

Crypto adoption remains strong in the Philippines

The Philippines is considered a major crypto market. The country ranks ninth globally in Chainalysis' Crypto Adoption Index 2025, driven by retail usage, remittances and mobile banking.

Local interest in digital assets has been further bolstered by government discussions on the creation of a national strategic reserve of 10,000 BTC, a proposal that has sparked debates in political circles.

GoTyme's new feature could bring crypto investing closer to the mainstream by integrating it into a regulated banking platform rather than an exchange. For many users, it could be their first direct contact with crypto assets.

It remains to be seen whether more advanced trading tools will be added, but the launch marks another step in the growing overlap between fintech, digital banking and crypto in the Philippines.