The price decline does not change the long-term view

The recent retreat of the price of Bitcoin has reignited the debate among analysts and investors, but not everyone reads the movement as a structurally negative signal. According to the experts at Bernstein, the current phase of weakness would represent one of the least convincing bearish scenarios ever observed in the history of the asset. In other words, the current correction would not have the characteristics typical of the deep bearish cycles of the past.

In fact, the research house maintains an ambitious medium-term projection, confirming a high price target by 2026. The thesis is that the market is reacting more to tactical dynamics and profit-taking than to a deterioration in fundamentals.

This shift in reading is relevant because it shifts the focus from short-term noise to the structural forces that are sustaining the Bitcoin ecosystem.

Less speculative leverage, more structured capital

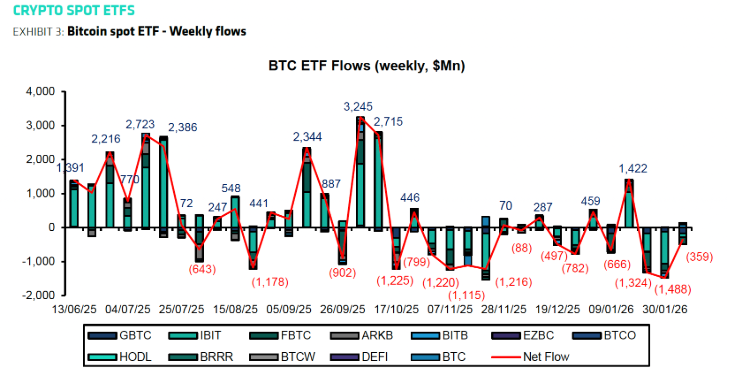

In past cycles, Bitcoin's big declines were often accompanied by excess leverage, haphazard crypto credit growth, and poor institutional presence. Today, the context appears different. The participation of regulated operators and listed investment vehicles has changed the composition of demand.

According to the analysis, the current market exhibits more robust characteristics than previous down cycles, with a broader investor base and more mature means of access. Elements that distinguish this phase include:

- greater presence of institutional capital;

- more robust custodial infrastructures;

- regulated instruments such as the ETF spot;

- less reliance on high-risk platforms.

Target on 2026 doesn't change

A forecast that looks beyond volatility

Despite the recent market weakness, Bernstein has confirmed its estimate of Bitcoin's value to 2026, maintaining a price target well above current levels. The valuation is based on a model that brings together institutional adoption, post-halving supply dynamics, and the growth of regulated investment channels.

The analysts' approach starts from a clear assumption: intermediate fluctuations do not cancel out the long-term trend. Volatility is considered a structural characteristic of the asset, not a signal of a cycle break. According to the research team, the recent correction does not have the typical traits of the large bear markets of the past. The market structure is judged to be more robust and backed by higher quality capital than in previous cycles.

"Presenting quantum computing as a 'Bitcoin killer' ignores the timing, the upgrade path, and the fact that the entire digital world shares the same vulnerability - and is likely to migrate in a coordinated fashion." - Bernstein said

This picture does not imply an absence of risk. Bitcoin continues to be sensitive to global liquidity, central bank decisions and regulatory developments. Stages of risk aversion in traditional markets may also be reflected in digital assets. In analysts' reading, however, these elements affect the timing of movements more than the structural direction of the trend.

Correction or constructive reset

The prevailing interpretation is that of a constructive reset rather than a cycle reversal. After strong rises, cooling phases help rebalance positioning and market expectations.

If the structural drivers - adoption, infrastructure and institutional participation - continue to strengthen, the current phase could be read as a technical pause within a broader path. For those who take a long-term view, the focus is not on weekly fluctuations, but on the trajectory of the next few years.