The line between prediction and manipulation is becoming increasingly blurred. Polymarket, the leading platform for blockchain-based prediction marketplaces, is now at the centre of a bitter controversy.

New suspicions suggest that the portal is not only being used to anticipate the future, but as a tool to 'launder' confidential information or, worse, to artificially steer global sentiment.

The precedent: the Maduro case and the Venezuelan 'leaker'

It all started with the so-called 'Maduro trade'. Earlier this month, an anonymous wallet turned a $30,000 bet into a profit of over $400,000. The user had bet on the removal of Venezuelan president Nicolás Maduro just hours before US special forces captured him.

Donald Trump said that a Venezuelan leaker is already in jail, according to reported by Lookonchain on X

Donald Trump said that a Venezuelan leaker is already in jail.

- Lookonchain (@lookonchain) January 15, 2026

We noticed that two of the three wallets that previously profited from betting on Venezuelan President Maduro being out of office have been inactive for 11 days.

The remaining wallet, "SBet365" placed another bet 2... https://t.co/GyZR4Lgd8i pic.twitter.com/fMP7QQ5tst

The case took on political overtones when President Donald Trump publicly stated that a Venezuelan whistleblower linked to the operation had already been arrested.

According to Lookonchain's data, two of the three wallets linked to those profits have been inactive for 11 days, fuelling speculation that law enforcement or exchanges were involved. However, a third wallet is back in action.

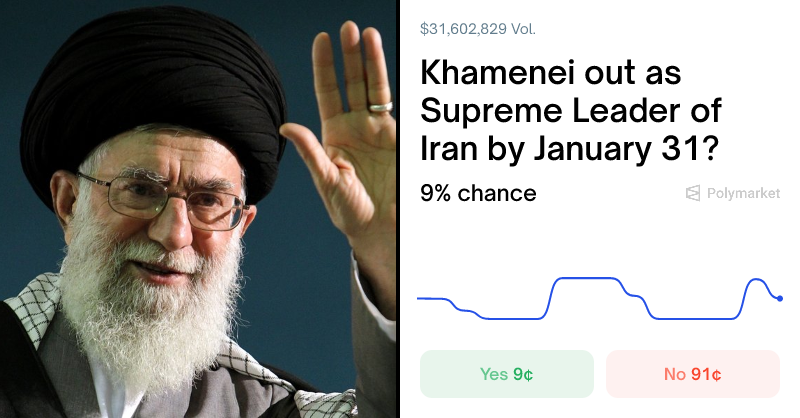

New shadows over Iran: bets on Khamenei's downfall

The surviving wallet placed a bold new bet just two days ago: it predicts that Iran's Supreme Leader, Ayatollah Ali Khamenei, will lose power by 31 January. As domestic protests shake Iran, the market remains open and under close observation.

This is not the only suspicious movement. Earlier this week, another large portfolio invested heavily in the possibility of a US attack on Iran by 14 January. During the escalation of protests and the temporary closure of Iranian airspace, the odds on Polymarket jumped 51%, with trading volume reaching $50 million.

Despite the tension, the attack did not happen. The market closed with a 'No', wiping out the trader's 255,817 shares and turning a potential win of $160,000 into a net loss of $40,000. Although the trade failed, the signal sent to the global markets was disruptive.

The Information Laundering Phenomenon

According to analysts, we are facing a new strategy called 'information laundering' (information laundering). This tactic involves placing a massive bet to shift the odds; once trading bots and social media amplify the news - presenting it as a real-time intelligence signal - the geopolitical narrative changes, influencing public opinion and even diplomatic decisions.

This account was created 40 minutes ago. It already has a $160,000 position on a US attack on Iran today. This is the only market he's betting on, does he know anything?", wrote a user on X.

This account was created 40 minutes ago.

- Moses (@holy_moses7) January 14, 2026

He already has a $160k position on a US strike on Iran today.

This is the only market he is betting on, does he know something? pic.twitter.com/YA0Ahqgxi6

Because Polymarket shares are widely shared on platforms such as X (formerly Twitter) and Telegram, a single well-orchestrated bet can generate headlines and move traditional financial markets before official confirmations even exist.

The politics response: the "Public Integrity Act"

The pressure on Polymarket has reached the halls of power in Washington. Congressman Ritchie Torres introduced the Public Integrity in Financial Prediction Markets Act of 2026. The bill aims to prohibit US government officials from trading in markets related to government stocks when they are in possession of non-public information.

Although the bill boasts dozens of cosponsors in the House, it has not yet been voted on and lacks a counterpart in the Senate. At the moment, there is no conclusive evidence linking trades on Iran to US government insiders, but the pattern of sudden bets and sudden reversals is pushing prediction markets into a dangerous grey area.

The risk today is not just about who is betting and how much they are earning, but how these bets are actively shaping what the world believes is going to happen, turning decentralised finance into a powerful, and potentially dangerous, tool of psychological warfare.